These are great points regarding free market capitalism, and successful people, but Joe Rogan.

Original article and pictures take s.ytimg.com site

These are great points regarding free market capitalism, and successful people, but Joe Rogan.

The Indian government has been cracking down on cryptocurrency-related tax evasion. While the tax authority has notified crypto exchanges and wealthy traders that they must pay taxes, no clear guidelines have been provided. Indians are confused about how cryptocurrencies are taxed and seven bitcoin exchanges are asking the regulators for clarification.

Also read: Russian Regulators Draft Law to Restrict Crypto Mining, Payments, and Token Sales

The Indian National Tax Service has recently inspected top cryptocurrency exchanges as well as sent out notices to wealthy crypto traders informing them to pay taxes. However, the government has not issued guidelines on how cryptocurrencies are taxed, leaving crypto users and exchanges confused.

The Authority for Advance Rulings (AAR) is the country’s adjudicatory body on tax matters. It consists of a retired judge of the Supreme Court and two members, one from the Indian Revenue Service and the other from the Indian Legal Service, its website describes.

The India Times reported on Friday that the country’s top seven bitcoin exchanges including Zebpay, Unocoin, Coinsecure, and Btcxindia are planning to ask the AAR for clarification. “At least one bitcoin exchange has already filed an application with the Maharashtra AAR for future tax liability,” the publication quoted sources with direct knowledge of the matter, adding that:

The tax department is currently researching the concept since bitcoin is a very complex subject.

“The question for many bitcoin players is whether GST is applicable on the total revenue or on the margins they earn,” explained Abhishek A Rastogi, a partner at Khaitan & Co law firm, noting that:

This is mainly because the tax authority must give clarity on whether bitcoin exchanges are selling goods and services, or are mere trading platforms that earn margins.

Meanwhile, the country’s “indirect tax department is already looking at ways in which bitcoins can be brought under GST,” the publication detailed. Furthermore, the sales tax department and VAT authorities have also launched their own investigation on the taxability of bitcoin.

“For the exchanges, the rate could depend on what the authorities deem bitcoins to be — goods, services or currency,” the news outlet elaborated. “If bitcoin is held to be a currency, there will be no GST. If it’s a good, then a tax of 18% could be levied, and 12% if deemed to be a service.”

What kind of taxes do you think the Indian government will impose? Let us know in the comments section below.

Images courtesy of Shutterstock.

Need to calculate your bitcoin holdings? Check our tools section.

While Indian government officials discuss ways to legalize bitcoin for tax purposes, the Supreme Court has given lawmakers four weeks to examine all security issues relating to digital currencies. Bitcoin.com recently reported on the government setting up a task force to evaluate whether to regulate and legalize bitcoin, which is expected to take 6 months.

Also read: Indian Bitcoin Adoption Responds to Government Signalling for Regulation

The Supreme Court of India has asked the central government and the Reserve Bank of India (RBI) for information on steps taken to ensure digital currencies are not used for terror financing or money laundering, reported News18 on Friday. The publication detailed:

The court has given four weeks to examine all security related issues pertaining to virtual currency, including bitcoin.

In addition, “a PIL claimed that the RBI was failing to regulate transactions in virtual currency,” the news outlet detailed. “It also alleged that virtual currency was being used for terror funding and money laundering.”

While bitcoin is already being widely used in India, News18 wrote that there is still “no clear law stating whether bitcoin and other cryptocurrencies are legal in India.”

The RBI has declared bitcoin illegal. On Wednesday, RBI Governor Urjit Patel, speaking at a meeting of the Parliamentary Standing Committee on Finance, reiterated this view. “The case of bitcoin was raised loudly and many Parliament members raised the question whether this currency is illegal in India,” India Today reported. The governor responded by saying “the Reserve Bank has already said that the cryptocurrency is illegal in India.”

While the RBI considers bitcoin illegal, the Finance Ministry is still evaluating whether to legalize and regulate the digital currency. Last month, Bitcoin.com reported on the Indian government setting up a task force to provide recommendations regarding bitcoin regulations in India.

Until the Finance Ministry has finalized its decision, bitcoin is “neither illegal nor legal in India,” wrote the second most circulated English-language newspaper in India, The Hindu, on Thursday.

A few Indian government officials have recently told The Hindu what they have been considering regarding how to regulate bitcoin. The publication wrote:

The government is considering the introduction of a regulatory regime for virtual or crypto currencies, such as bitcoin, that would enable the levy of the Goods and Services Tax on their sale.

In contrast, Japan and Australia have recently abolished their goods and services taxes on bitcoin purchases. Japan modified their tax law in April but it went into effect on July 1 whereas Australia had been working on removing bitcoin double taxation for over a year.

In the meeting chaired by Finance Minister Arun Jaitley last month, a few options were discussed such as limited regulation. “This means reiterating that cryptocurrencies are not recognised and those who deal in them do so at their own risk, while focusing on curbing illegal activities,” the news outlet described.

“A proposal to ban such currency altogether was also considered at the meeting,” according to the newspaper. However, only a few top officials were in favor of this option from the Ministries of Finance, Home Affairs and IT, the Securities and Exchange Board of India (SEBI), the RBI, the State Bank of India, and NITI Aayog.

A government official told the news outlet that “the discussion on whether cryptocurrencies should be banned or regulated has been on for some time,” adding that the pros and cons of this option were discussed at the meeting. A different government official familiar with the matter said:

Banning will give a clear message that all related activities are illegal and will disincetivise those interested in taking speculative risks, but it was pointed out it will impede tax collection on gains made in such activities.

Instead of banning, the government discussed how regulating bitcoin would boost blockchain technology and “encourage the development of a supervision ecosystem,” which they believe tracks both legal and possibly illegal activities. In addition, it will “promote a formal tax base,” the official said.

If the government decides to regulate cryptocurrencies, then they would be treated as “digital asset, similar to gold,” The Hindu explained, noting that they will be traded on registered exchanges. This “would ‘promote’ a formal tax base, while keeping a tab on their use for illegal activities such as money laundering, terror funding and drug trafficking,” the newspaper detailed. “The new regime may possibly bring their trading under the oversight of the stock market regulator, Securities and Exchange Board of India (SEBI).”

What do you think the Indian government will do about bitcoin? Let us know in the comments section below.

Images courtesy of Shutterstock, Livemint, and Networked India

Need to calculate your bitcoin holdings? Check our tools section.

Bitcoin is trending in India as the decentralized currency reached new price highs this week. According to multiple reports, the country’s top exchanges Zebpay, Coinsecure, Unocoin, and Bitxoxo are seeing unprecedented user sign-ups and massive trade volumes.

Also read: Bitcoin in India: ‘The Best Form of Money the Human Race Has Ever Experienced’

Cryptocurrency fever is finding its way across every nation in the world, and India has been bitten by the ‘bitcoin bug’ for quite some time. This week the regional publication the Economic Times says Indian citizens and well-known investors from the region are “bullish” for bitcoin right now. India’s top exchanges are seeing a rush of people trying to obtain bitcoins with an exponential amount of registrations taking place this month. The Delhi-based Bitcoin exchange Coinsecure executive Vivek K explains;

We are flooded with requests — In the past week alone, we have seen double the number of registrations — Signups are happening at full capacity.

The co-founder of Zebpay expresses the same sentiment and says the firm’s INR/BTC trade volumes have been through the roof.

“Every three months our bitcoin trade volumes have been doubling, and that trend is continuing — The price movements have helped in the volume increase,” explains Saurabh Agrawal, of Zebpay.

Additionally, Unocoin is registering 5,000 users per day, and the trading platform’s user base has grown from 100,000 to 700,000 this year. Another bitcoin brokerage service Bitxoxo says they are registering 3,000 users a day, and the firm also notes that most of the new registrants have become active traders. Indian exchange executives are even claiming ‘high profile’ investors are stepping into the bitcoin economy as well. Coinsecure’s representative states;

There are high net worth individuals, trading companies, and corporate entities exploring this space. Experienced stock traders and analysts who study the charts are interested in investing because of the surge in price.

However, government officials from India are still on the fence about their decisions to regulate bitcoin and other digital assets. On Friday December 1, Finance Minister Arun Jaitley told the press that India still has not validated bitcoin as a legal tender. Jaitley has stated earlier this year that exchanges have not been given the ‘green light’ yet by the Reserve Bank of India (RBI). At the time Jaitley said bitcoin-based businesses were not licensed. The Finance Minister explains that even now bitcoin is still not recognized as tender.

“Recommendations are being worked at — The government’s position is clear, we don’t recognize this as legal currency as of now,” Jaitly details.

Bitcoiners from India don’t know yet what the government will decide in regard to bitcoin in the future. A while back an online petition that had captured over 15,000 signatures, including the exchange executives mentioned above, was submitted to the government asking them to legalize bitcoin. In addition to exchange registrations and bitcoin volume in India at record highs, the peer-to-peer platform Localbitcoins is also seeing massive bi-weekly trade volume.

What do you think about bitcoin’s popularity trending in India? Let us know in the comments below.

Bitcoin.com is the #1 portal for all things Bitcoin. We have the hottest trending news, forum, games, and so much more!

The post India’s Bitcoin Fever Sees Trade Volumes and Exchange Sign-ups Spike appeared first on Bitcoin News.

from Bitcoin News http://ift.tt/2zYvuBq http://ift.tt/1L2dnrU

– Important Upcoming Ripple News that could Increase the Price of XRP – HODL! – Ripple Prediction,XRP Price – –

Bitcoin Bounces Beside Ethereum & Litecoin - Live Crypto Updates - BITCOIN BULL MARKET BEGINS?…

Ripple Expected To Rise To $11.45 After Market Crash!? | HERE'S PROOF | HUGE XRP…

How to Make Money in a Down Market! - My Investment Strategy! - Bitcoin NEO…

Imagine for every $7 i spent to get $100 out or more. This is what i could achieve at the end of 2014 just by investing any spare amount of time or money into bitcoin now!

Then what if i told you. That no advanced knowledge, technical skills or complicated processes are ever required.

The Bitcoin Miracle will explain everything step by step, without any techno babble. It will also show you how to obtain 100% free bitcoin, or even purchase some via PayPal with no fees.

You have no reason to put off bitcoin any further. Everything you need is included inside, absolutely nothing is held back.

Don’t for one second think bitcoin is a bubble, fad or phase. Its here to stay long term, as proven, time and time again.

It Isn’t controlled by any central authority or fat cat trying to manipulate the system for profit. It just can’t be done.

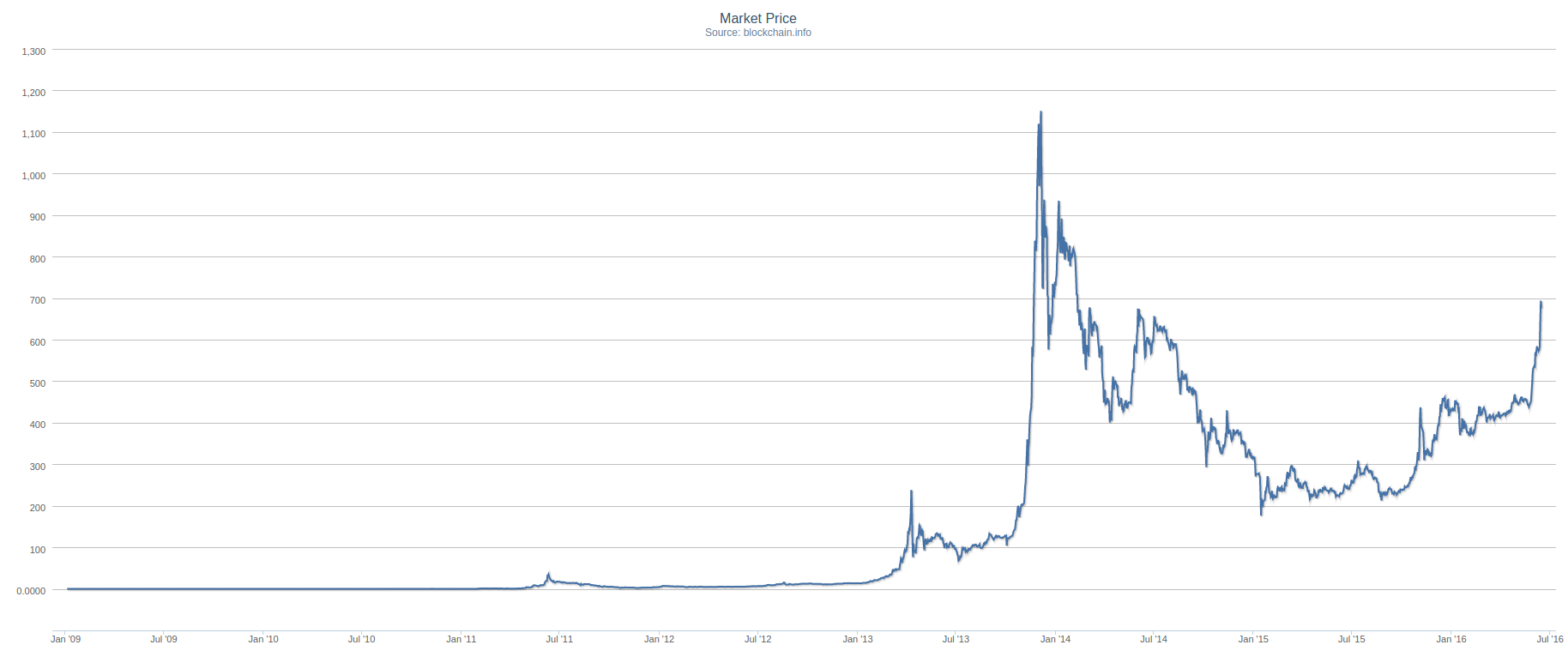

As you can see by the chart above, the price of bitcoin has exploded and is only forecast to increase this year, and next.

In January 2013 bitcoin was worth around $15, now its worth up to $1200. Imagine if i just bought one bitcoin back then at $15 … I would now be $1185 better off with zero work!

Just imagine i had 100 bitcoins last year … I would now have $120,000 worth of bitcoins!

If i spent just one hour per day following the free methods outlined in the course to earn just 0.01 bitcoin then its possible by the end of 2014, i would have $36,000 or more.

Imagine if i spent two hours per day, that’s a $72,000 payday right there at the end of 2014!

Further still, if i applied the multiply method, or followed several of the other methods included, i could possible earn:

Don’t think $1,000,000 is exaggerated, it could actually be underestimated! Multiple sources have predicted bitcoin to be worth $1 million per coin in the future. So one measly bitcoin now, can be worth a fortune in the future.

Working one hour a day with the methods outlined, will net me 3.6 bitcoin a year roughly. If it hits the prediction of $10,000 per coin, i would have $36,000 as mentioned above.

But what if it surpasses that prediction, and is $20,000 per coin, $50,000 per coin or even $100,000 per coin?

This is Milton Friedman, he’s regarded as the greatest economist of the 20th century.

He actually predicted that there would be a currency exactly like bitcoin in 1999!

He believed it would reduce the roll of the government significantly and become the backbone of payment processing online.

There are in fact thousands of websites and businesses that now accept bitcoin, from tiny bars to las vegas casinos. Amazon is also predicted to accept bitcoin in 2014. Heck, you can even go into space with virgin galactic if you have enough bitcoins!

Don’t take a backseat and watch your opportunity to make endless profits with bitcoin disappear. Take action today, and secure your future.

Bitcoin Miracle comes in an electronic form, after you order, you get immediate access to the ebook, no waiting, no shipping fees!

So, the choice is now yours, are you ready to take the leap and start incorporating Bitcoin in your business? Are you ready to start trading Bitcoin and Litecoin to make easy money? If so, grab YOUR copy of Bitcoin Miracle now!

In this series of articles we explore how people make money on the Internet. We will attempt to give an objective view on every subject we investigate – we have no affiliate relationship to anyone specific mentioned in this series. Don’t be surprised if we conclude that this subject might not be a good way to make money. All opinions expressed here are just that – our opinions.

BitCoin, simply put, is decentralized digital currency, or cryptocurrency. They can be sent from person to person through the Internet, making fees lower because there are no middlemen such as banks or clearinghouses. Anyone can purchase these funds through Internet exchanges like BitCoin Classic or BitCoin XT, just to name a couple.

READ: How to Make Money Trading Altcoin

This currency was developed in 2009 by Japanese developer(s) Satoshi Nakamoto. There is a swirl of mystery because it is unsure who this is. There have been claims that this is one person or a group of people, but no one is really sure. Some research suggests that companies Like Samsung, Nokia and others had something to do with this currency. Personally, this leads a little doubt about BitCoin because people, in general, want to know that something is real and where it came from. A name is just a name until you can put a person or persons behind it. It only hurts the exchange to mystify the creator or creators.

When purchased or mined, BitCoin can virtually be used similarly to your currency through any payment online service that accepts this currency, including businesses and person-to-person exchanges. There are claims that this currency can transcend to “anything that can exist,” as expressed by Craig Wright, the person that was first thought to be Satoshi Nakamoto. This means that you will be able to shop with them in day-to-day transactions. Some BitCoin users already do this. There are stores and shops that take this currency, as well as a few Internet sites. There are also places on the Internet where you can gamble with them, trade them, purchase them, or pay for commodities with them.

Aside from gaming, as mentioned above, there are quite a few of other ways that can but BitCoins in your wallet. Entrepreneurs have been brainstorming to get into the BitCoin market one-way or the other. There are several ways to produce BitCoins that they have found:

One such way is to build your own website and teach courses about BitCoins for a nominal fee. There is also the option of placing BitCoin advertisements on your own website where you get a small fee when others access the ad through your site.

Faucets for BitCoins can be more than just a game once you know how to use them. Setting up a faucet can be found in tutorials on YouTube.

Of course, you can always take a chance and gamble with BitCoins but unless you understand that you can lose just as well as any other currency and if you plan on using BitCoins it is better to stay away from that. There are odds in gambling with BitCoins, just like any other currency.

There are even faucets that you can just hit a ‘claim’ button on that will give you free Satoshi after a waiting for a certain amount of time. The two I chose to sign up for have a waiting period of 15 and 20 minutes before I can tap the button again. Of course, Satoshi that can be harvested from some of these free sites but there are many that you will never be able to withdraw from. I do not hold out any hope of gaining from these faucets. Signing up is more about research and satoshi from these sites are like picking up pennies, anyway.

There are websites that will micro-pay in satoshi for small analytical tasks. This is similar to MechanicalTurk at Amazon.

Another passive option is to use bots that will automatically trade, for you. The convenience of letting a BitCoin bot trade for you seven days a week, 24 hours a day is as passive as it can get. There is a market for trading the BitCoin, so this is another way to make money if you understand the core of the stock market and the concept of supply and demand.

Originally, mining for BitCoins was the main source of building the market for BitCoins. Since there is only 30% of the total 21 million left to mine, other options to add to your wallet had to be found. Since BitCoins are treated as currency, the concept of loaning with a fee is also a way to make money. Banks give loans to charge interest and make money. Following that model is pretty easy to do.

After researching the many types of ways to accumulate wealth, there are a couple types of websites to steer clear of. Any website that wants a plug-in added to your computer should be a red flag. There is just too much of a risk that your computer will be infected or hacked.

The way BitCoins are stored is a “wallet” that you can have on your computer or cloud storage. This is similar to a bank account online. It is with a critical eye that anyone can say for sure that BitCoins are safe or secure. Breaches have occurred by unsecured wallets, not at the blockchain. Make sure your password is able to protect what you have in your BitCoin wallet. Make sure you never share it and it is strong. There are several different ‘wallets’ available. There is the paper wallet, mobile wallets, desktop wallets, online wallets, hardware wallets and USB wallets. They have varying security, based on your decision and price range.

There are some variations of this, but a BitCoin wallet is simple to set up. It takes a few pieces of your information but is relatively secure, based on your password. Once the account is set up, the wallet becomes a text file that is specific to you. It is protected by encryption through the browser you use. This is simply like opening your very own bank because you are the only one that knows how much you have in your account and the encryption stops everyone else from accessing the account. Wallets online are usually stored in the online cloud and still there is no way someone can access it unless your sign in protocols are weak or you shared the information. The wallet offered through Blockchain is connected to its namesake to look up your account when you log in and there is no need to download the blockchain at all. No one can view your account balance, addresses you have in the wallet, and transactions can only happen when you make them. No one is able to make any transaction except you. When your wallet is saved in the cloud there is no way that anyone can steal it. You don’t even have to use the blockchain.com website.

Basically, the blockchain is a list of transactions concerning BitCoins. The problem here is that in order to use BitCoin, you will need to download the blockchain. This can be a problem because the blockchain is so long and takes up the memory of the user’s computer. Unless you decide to save it in the cloud, there will be many users that will be unable to access their BitCoins except by leaving their wallet in the cloud. Since the blockchain has been in place since the inception of BitCoins in 2009, there is a pretty good chance that your computer will not be able to hold the Blockchain at all. Wallets can, however, be used to house the Blockchain. A better option here is to use the cloud to keep it in. Another problem, there is no central database to house this. From this perspective, there is no known regulation. The only option is the BitCoin wallet. Of course, this is one of the solutions at present, unless you want to purchase storage beyond the capacity of your computer. To sum up what a Blockchain is, think of it as the checkbook register or ledger that everyone uses when using BitCoins.

This started with algorithms (mathematical equations or processes) that could be easily answered, producing BitCoins. Of course, over time, answering these algorithms has become more difficult. Some people have grouped together to solve these equations and receive BitCoins based on their input to solve them. In some cases, people purchase mining software. There have been 14 million BitCoins mined with a limit of 21 million in existence. Since that represents 70%, realistically, mining is a harder process than thought. Mining was designed to be difficult, which limits the amount found. By 2140, miners will end up being dependent on transaction fees, based on the projection of the last BitCoin to be found.

Depending on how you use BitCoins, and the market, they are similar to stock markets. The risk here is that BitCoins can vary over the course of time. BitCoin value can and does fluctuate. Of course, as previously stated, the security of BitCoins is as secure as your password but there has not been a problem with the BitCoin blockchain. They are also not a common use of currency. There are many places that look at the BitCoin and refuse it because their governments do not recognize the value. In order for governments to recognize this medium, there have to be certain criteria.

Another risk is the volatility of the market of BitCoins. At the beginning, there wasn’t a market so there wasn’t a cost. This allowed people to collect them, like Craig Wright. Supply and demand determine the cost.

Right now in the US, the Financial Crimes Enforcement Network (FinCEN) monitors any converted BitCoins to USD because banks report it. Of course, the problem we have here is that the government takes the stand that BitCoins are not legal tender and cannot be considered real because the population does not use it as a whole. Otherwise, the government would make policies and rules to govern this form of currency. What makes this more difficult for governments is that the BitCoin is used worldwide and cannot be tracked in usual ways, online.

To be fair, there have been rumors that just aren’t true about this system of currency. The idea that this is a Ponzi scheme is just not true. A Ponzi scheme has to do with the payment to older shareholders by using the money from new shareholders, in substitution of profits. This does not make any sense, since this has no centralization, like a bank, it is just not possible.

There have been rumors that drug dealers use BitCoin and that the system has been hacked. These are just rumors. What isn’t a rumor is that money can be taken when the website has been attacked by hackers, not your BitCoin wallet. There is always going to be a downside to something that is not widely understood. BitCoins are no different. We all need to explore and research for information to make the best decision possible.

The BitCoin has been scrutinized because they are not considered legal tender in many jurisdictions. This is true because it has been restricted or banned for use in some countries. There are many governments that are looking into how or if they want BitCoins regulated.

When looking at the BitCoin era, this currency has been off to a slow start. This form of currency is still in its childhood with the potential to survive and thrive, if and when it is accepted. The software is still in development to make it better by developing better security and accessibility. Time will tell. There are some websites that give you the option to learn by giving you a simulated account before if you are unsure of the BitCoin cycle. Whether this technology survives or sinks, look up a website where you can use a simulation to see if this is something you can understand and get accustomed to. This may or may not be the next step for all of us. It is definitely better to be prepared, just in case.

If you want to sell a product or service, BitCoin is a viable alternative to normal dollars. But beware, BitCoin is an attractive option for people in need of an unregulated currency. Many pyramid schemes deal in Bitcoin as sole means of payment. Their promises to get rich quick are tempting and will more often than not cost you.

Unfortunately our world economy is based more and more on virtual pillars – in Bitcoin’s case the fact that the brain wallet password cannot easily be broken. Keep in mind that any technology can suffer a disruption. In fact technology begs disruption. We don’t want our financial system to suffer if the unthinkable happens and BitCoin is breached. Might this new generation of learning processor contribute to the coming disruption?

Let the buyer beware. Cryptocurrencies are still in its Wild West days, keep your head low pardner.

Yes that is a very bold statement and I will show you how you can do it step by step.

2. Buy Bitcoin (BTC)

If you are in US:

When you buy through this link or sell $100 of digital currency or more, we both earn $10 of free bitcoin!

If you are outside US then you can buy it from Localbitcoins: http://www.LocabBitcoins.com

Or through your local exchange in your country.

3. Deposit Bitcoins in your Bitconnect Account that you created in step 1.

4. Convert Bitcoins into Bitconnect Coins (BCC)

5. Invest $100 into the program

6. Daily watch your money grow…and hit that reinvest button every time you have USD 10 in your lending profit.

7. Within 24 months your $100 will grow to $65,000

Albert Einstein is credited with saying:

“Compound interest is the 8th Wonder of the World…

He who understands it earns it… He who doesn’t pays it!”

Disclaimer: The information is for educational purposes only, and it is not intended as investment advice. Only invest that much that you can afford to lose and even though most of

the information are truth we give no representation, warranty, or guarantee as to the accuracy or completeness of any such information. You represent that you have been, are, and will be solely responsible for making your own independent appraisal and investigations into the risks of the transaction.

People with money are always looking for the best way to invest 100k or how to invest 100k.

Others are searching for methods of online investment. There are so many investment opportunities in the cryptocurrency market. Infact, If I had to come up with investment plans, I would direct you here. This is the best place to invest money in small investments that will turn out to be good investments. So, if you are looking for where to invest money, I have shown you important investment ideas, the best investment firms and told you how to invest your money. Of all the investment options, how to invest in gold, this is the best investment advice, and with an investment account, it will be the best way to invest money, have safe investments for those looking for alternative investments.

Talking of low risk investments, this is the best way to invest 1000. Looking for good companies to invest in, this is how to start investing, it is how to invest 10k.

investment strategies

what should i invest in

microinvest

direct investment

how do i invest in stocks

investment club

types of investment

investment income

how to invest in water

investing 101

how to become an investor

start investing

how to invest 1000 dollars

learn to invest

how to invest money to make money

investing basics

how to make money investing

investment news

what is investment

how to invest in s&p 500

investing money

investing in stocks

investment companies

best investments

how to invest in stocks

investing for beginners

how to invest money

best stocks to invest in

stocks to invest in

how to invest

how to invest in bitcoin

investment calculator

how to invest 100

where to invest 100k

how to invest 100 dollars

how to invest 100000

best way to invest 100000

invest 100k

how to invest $100

invest 100

invest 100000

invest 100 dollars

invest $100 make $1000 a day

best place to invest 100k

how to start investing with 100

best investment for 100k

best way to invest 100k safely

start investing with 100

how to invest in the stock market with 100 dollars

invest $100

how to invest $100000

how to invest 100 dollars in penny stocks

best way to invest 50000

how to invest 50k

best way to invest 100 dollars

how to invest 100k to make 1 million

how to invest 50000

how to invest 100 dollars and make money

best way to invest 100000 dollars

investing in shares

how to invest in share market

how to invest 100000 dollars

where to invest 50k

how to invest in property

how to invest 100 million dollars

how to invest in shares

how to invest 100k in real estate

invest money online

how to invest money wisely

how to invest in oil

best way to invest 100 million dollars

what to invest 100k in

investment fund

investment guide

investment products

what to buy with 100 dollars

invest $100000

best way to invest $100000

how to invest 500

where to invest your money

great investments

how to invest in silver

how to invest in stocks for dummies

guide to investing

how to invest my money

how to invest online

what investment

how do you invest in stocks

where to invest now

how to invest 10000

how to invest in stocks with little money

what to invest money in

how to invest in forex

where to invest my money

how to invest for retirement

how to invest 20k

where to invest money now

how and where to invest

business to start with 100k

how to invest 5000

how to start investing money

how to invest 50000 dollars

how to invest 1000

how to invest money in stock market

how to invest in stocks for beginners

how to invest in commodities

ways to invest

ways to invest your money

what can i invest in

investing with little money

how to invest with little money

how to start investing in stock market

how to begin investing

how to invest small amounts of money

how to invest in stocks and bonds

how to invest in reits

how to invest in a company

safest way to invest money

how to invest for dummies

how to invest in etf

how to invest wisely

investing in stocks with little money

good ways to invest money

how to invest in currency

how to invest 20000

how to invest $1000

smart ways to invest money

how to invest 10000 dollars

how to be an investor

how to invest 30k

how to invest money online

best way to start investing

i want to invest

what is the best thing to invest in

how to invest and make money

how to invest 200k

how investing works

different ways to invest money

where to invest 10000

how to invest in lithium

invest money to make money

how to safely invest money

how to invest 500000

how to invest $10000

how to invest 500 dollars

how do you invest money

how to invest with no money

how do i invest

how to invest in apple

where to invest cash

where to invest 100k in 2017

how do i start investing

best way to invest 500

how to invest $5000

investing small amounts

how to invest in options

how to invest $500

investing 1000 dollars

how to start investing in stocks with little money

where to invest today

how to invest in futures

how to invest $20

how to become a day trader with $100

how to invest cash

how to invest 5000 dollars

how to invest in

how to invest 3000 dollars

how to invest 5k

how to invest in ipo

how to invest savings

how to invest in art

where to invest 1000 dollars

how to start investing with little money

how to invest in stock market with little money

how to invest 100 000 dollars in 2017

what can i buy with 100 dollars

how to invest smartly

how to invest money to make money fast

why invest

how do you invest

best way to invest small amounts of money

how to invest in farmland

100 bucks

how to know what to invest in

saving 100k

what can you buy with 100 dollars

how to invest 200 dollars

how to invest in copper

how to get into the stock market with 100 dollars

small investments that make money

small money investments

best things to buy for 100 dollars

dollar investing

how to make money with 100 dollars

how to invest when young

how do i invest in mutual funds

100 dollars a month

how can i invest my money

is investing in stocks worth it

things you can buy with 100 dollars

i want to invest my money

things for 100 dollars

People keep asking me how to properly invest into the crypto-economy. What do I need to know? How not to lose money? How should I choose the right cryptocurrency for my portfolio, which will skyrocket in the future?

In this guide you will find an exhaustive list of answers to many of these questions. But first, before giving you an explanation on how to invest, let me address the question: why should you even need to invest your hard-earned money? I’ll try to explain this as simply as possible.

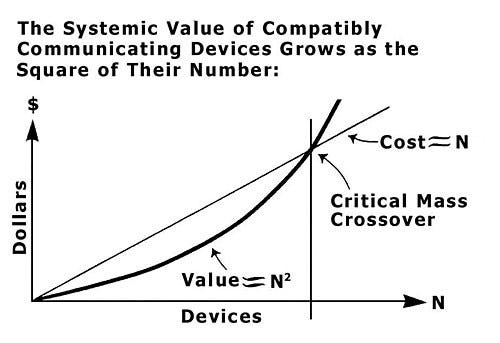

Over the last 20 years with the invasion of the Internet, many people have earned amazing amounts of money on one simple thing - the Network Effect. What the hell is that? In the 70-s there was an engineer Robert Metcalfe. He invented what we now call the Ethernet. In order to make a profit on this invention, he began selling network cards. At that time people didn’t understand why computers needed connect to the network. Robert realized that it was necessary to find a reassuring argument to prove that his network card was just the right panacea for all their illnesses. Robert said:

The network’s value is proportional to the square of the number of users in this network.

Well, you buy 10 computers without a network card, their conditional costs are equal to 10. However,with network cards the conditional costs of 10 computers will increase to 45! This is 4.5 times more profitable! “Wow” — corporate workers said and then they began buying Robert’s network cards.

It turned out that Robert’s idea is quite reasonable! You can use it to assess Telecom companies which have rolled out across the globe with redoubled force. The capitalisation of Telecom companies depends on the number of its users. The dependence is not a straight line but a quadratic. At the dawn of the social networks, venture capitalists quickly remembered the cherished formula and applied it to such things as Facebook, Twitter, Skype, etc. So the Metcalfe’s law was proven correct and gave us millions of Ethernet grids which evolved into what we now call the Internet.

Simple truth — if the number of network users is steadily growing, the exponential growth of your investments is expected to grow with it. Thus, Facebook was worth more than $ 300 billion. The formula is simple. Looking for a network which is growing steadily at the very beginning => put money => wait => profit! The question is — why Bitcoin? Because it’s the same network and it’s growing. Is growing quickly. Check for yourself:

Of course, these figures are very approximates, because there is no way to determine the exact number of users. The numbers listed above are my own assessment. To make it look more convincing here is a graph of Blockchain.info wallets

Question: How long it will grow and when the growth will slow down?

Answer: Blockchain technology refers to a class of technologies “No Way Back”. This is when Homo sapiens starts to use something and could not imagine how they lived without it. Here’s a graph in the case of TV, electricity and other technologies:

Growth will be carried out at the S curve until saturation occurs.

There are about 3.5 billion people who use the Internet, and about 20 billion connected devices or just bots. Considering that the Bitcoin network has properties that are not offered to us by any Government or Corporation, we can assume that there is a high probability that the majority of connected people and machines will use this network. What are these properties?

The list of benefits can go on and on, but you get the idea. This is a kind of manna from heaven, which is better money in comparison with paper dollars. But most importantly:

It’s just the economic miracle of mathematics, cryptography and computer science.

Investment in the blockchain as the best investment opportunity since the start of the Internet

In the current economic circumstances the deception is carried out in 3 ways:

What’s surprising here? How this bubble can burst if there is no alternative? For some reasons no one admits the idea that an alternative to the сurrent outdated system is already there. Which is great! That suggests that a Black Swan is not such an unlikely event. In the case that a negative event has at least some probability, smart financiers are recommended to hedge risks. Let’s guess , what’s the alternative?

Right — is Bitcoin.

Investments in the blockchain as the protection from fraud of Governments and Central banks.

There is another argument in favor of the Blockchain: robots and artificial intelligence. The reality is that we don’t know exactly when computer algorithms will be able to solve all the problems that we can, including creativity.

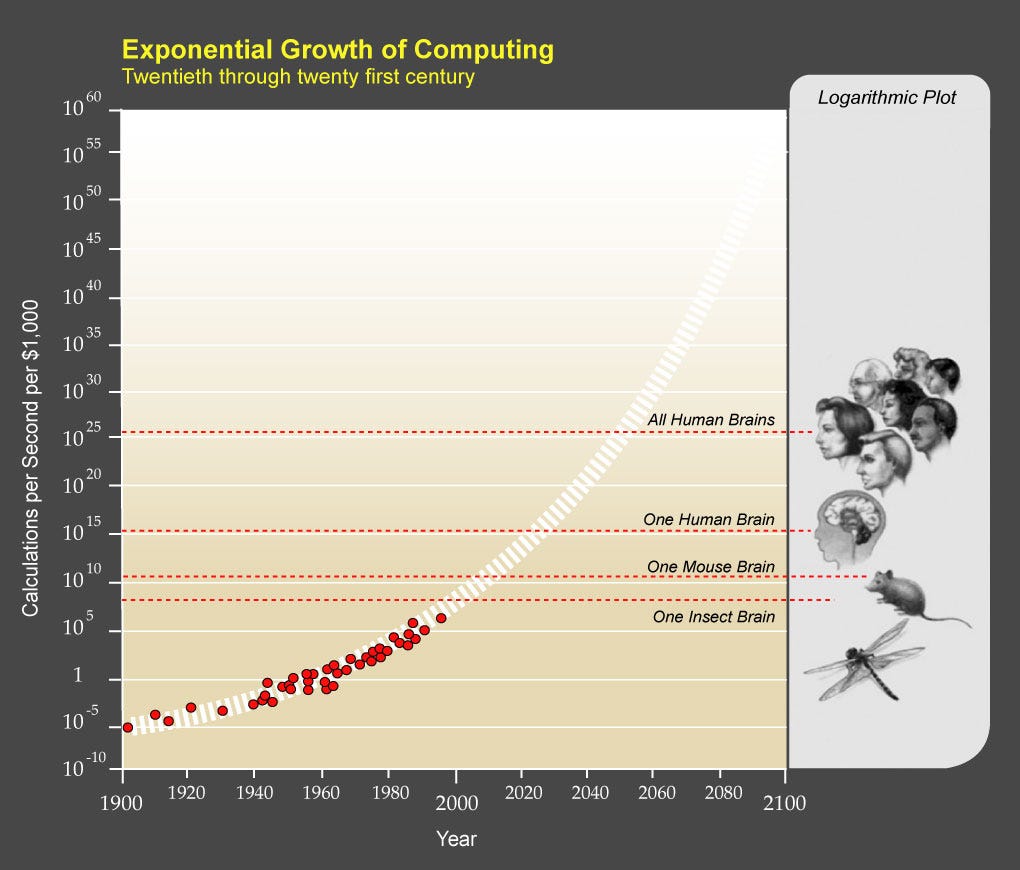

Today is 2017. The computing power of the device which cost $1000 approximately equal the computational abilities of the mouse. In accordance with Moore’s law in 2025 (and perhaps earlier, e.g., in 2022) the cost of computing by humans biological brain will be compared with the cost of computing by computers.

Let me give you some real live examples from different areas:

The algorithm that broke one of the strongest players of Go is available on Github and it is called “Tensor Flow”. Any school student can click on the “Fork” button and make everything that comes into his mind. This accessibility of really smart technologies will inevitably lead to the emergence of a new generation of smart devices. Autonomous robots will be able to earn money and consequently make economic decisions. And as soon as the first striking example occurs — the Homo sapiens may get nervous. His job may be under threat.

There are more Bots than humans. This amount will increase and Bots will become smarter. Thus, the risk of devaluation of your (and my) intelligence is real. And the longer you deny it, the faster your brain will depreciate in value. The point is that the blockchain is convenient for a robot economy . It is understandable, it is reliable, and it is easy to integrate. The Blockchain for the Internet of Things is a new megatrend. It is obvious that without the blockchain — robot’s economy simply impossible. The solution is right here:

Investments in the blockchain as a hedge against the depreciation of your own intellect.

In addition to the von Neumann architecture, there will be quantum computers in the future. The Moores law for quantum computers will work in the square.

So, you have some incentive ideas in your head and you already want to buy Bitcoins. Your blood starts to boil. The brain anticipates an incredible profit. All the free energy is concentrated on the sources of investment.

Calm down! Turn ON your Brain

The blockchain is a really cool technology and it is growing rapidly. But there is no guarantee that you will be able to make profit. I will list some necessary conditions that must be followed to increase the probability of a profitable outcome.

A mandatory condition for safe investments in the crypto-economy is a basic computer literacy. If you don’t know how computers works, then think twice before putting your wealth. Then the question arises: How do you I know if I have this basic computer literacy? These bullet points will help you understand a little bit more about it:

If you answered “Yes” to even one question — your computer literacy want to be better, and you need to take this into account when investing in the crypt-economy. Otherwise, you have a high probability that something will go wrong.

Check my tutorial to know how to store Bitcoins and altcoins in a secured way.

You have already realized that there is no freebies, and risks, in fact, are more than you thought! You need some time to determine how much to put down for investment. General recommendation: from 1% to 10% of an available financial assets you currently have. If you have confidence in your own computer literacy, then the percentage can be increased up to 30% and even 50%.

It is very important to start from amount of your financial assets. An appropriate financial assets are currency, stocks, bonds, shares. Property, cars and other things that can be touched, are not included here. Although, I’ve heard a story about one guy who sold his apartment and bought Ether on all the money. Heroes must be known in person, so let me know if you read this!

So, if financial assets are greater than $100k — you’re lucky:). Buy cryptocurrency in the amount of from 1% to 10%, depending of your risk appetite.

If your financial assets are in a range of $10k-$100k — you have something to lose. You are neat, consistent and purposeful. Allow yourself a little risk and roll up to 3%-20%. Your well-being is not significantly affected in a case of losses, but it can teleport you into the category above sooner than you would want to leave your current work.

If financial assets you have are up to $10K — you are still ahead. The amount is already nice, but it is not enough to feed itself. When there is a stable source of income, start from 5%, and when you will be confident — raise the rate up to 40%. Think about your strategy: 5% for retirement. When you got paid — put 5% on the blockchain. If you maintain schedule within 1–2 years you will be pleased with your investments.

If you do not have anything, then best suited strategy is “all-in”, because you have nothing to lose. With such financial discipline — hardly something will help you! So is there any chance that something will changes in your life .

But I’m still a kid!

Great! Bitcoins are for you! Governments, banks and even your parents think that you can’t have something for possessions, without their permission. Prove to them that this is not true. If you are reading this article, probably your computer literacy is much better than most of the people around you. So don’t believe them. They are stupid. By the time you finish school, banks may disappear altogether, Governments may become autonomous code, your parents may lose their job in connection with the invasion of artificial intelligence, and your kettle might be richer off than your entire family. But if you’ll have a few bitcoins and tens of Ether, your coevals will look at you differently. Girls will love and parents will be proud. Look at Vitalik Buterin. His first bitcoins appeared when he was 16 years old. It was interesting. He began to write and study. Then he didn’t go to University, but created Ethereum. Now, professors of the world call him Mr. Vitalik Buterin. If you will start to accumulate anything from 6, 8, 10, 12 years you will have a good future.

Prepare to wait a long time.

If you’re not ready to freeze your money less than for 3 years — close the tab and move on. There is nothing for you. Blockchain market is in the embryonic stage. It may be rocking back and forth. The clear strategy is Buy & Hold. Bought and keep. I recommend to plan it as a long-term investment with some simple strategy of fixing. For example, detecting 10% each time when the net asset valuation increased 5 times from the previous commit. Well, it’s simple! But this strategy will only work if you define the investment horizon in a radius of 3–10 years.

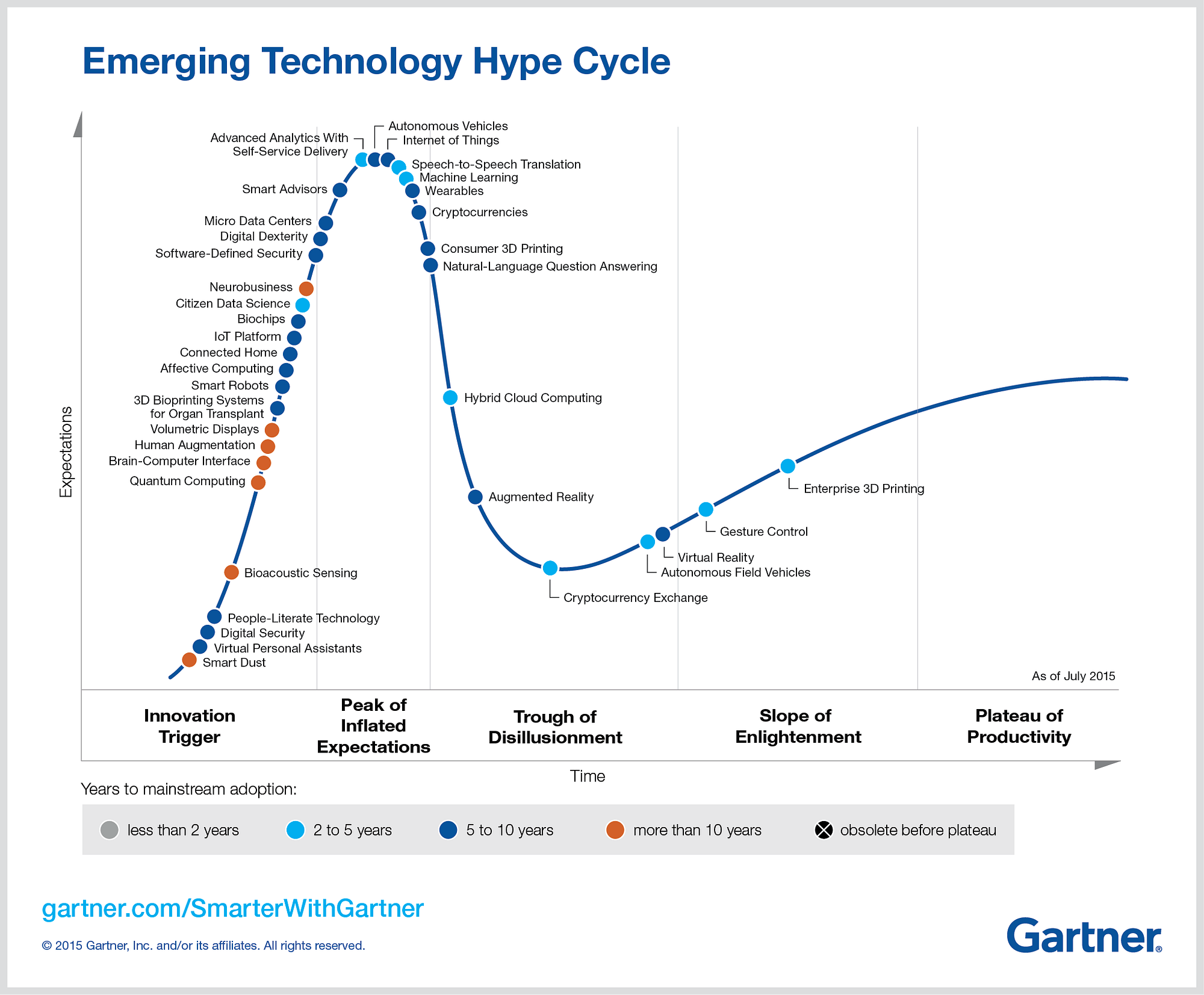

Here’s what is thing about. There are all sorts of technology is growing unevenly. The guys from Gartner explained it very simply:

New technology occurs and all at once are amazed from the new technology. This is called the peak of inflated expectations. But the technology is still not working as it should work. Therefore, the technology comes at some point of disillusionment. And then it either disappear or becomes productive.This principle works for all technologies.

So. In our history, all looks the same.

Any blockchain system grows very similar. I am telling this in order to give you one simple idea:

Do not buy when everyone amazed.

If you see that in the last month something has increased several times, this is a great reason to look at buying, study, and find a more optimal time to enter when the market goes down.

Strategy “Buy & Hold” also means that if you find an interesting asset, it is the time to start buying when it falls, and purchasing until it starts to grow.

Previously, I have discussed about assets that already existed and were traded on the markets. But where did they all appear? After all, it’s better to be at the forefront of “something great”. Essentially there are two options:

Both approaches in different cases makes sense. Sometimes, these two approaches should be combined. But in the second case, we have the opportunity to participate in the creation of something which is risky. Thus was created Ethereum, and many more.

Question: how to determine that this is something where I put the money is great, but not some sort of regular wiring?

Answer: Behold the root. We look at three things:

If at least one item has not converged, then don’t risk. Of course, there are a lot of additional factors:

Generally, all these criterias are not exhaustive. However it is enough to understand that making such decisions requires analysis and understanding of whole picture.

Guys from cyber.fund collect significant ICO in their radar

Yes, there is such a thing. Recently a lot of my friends sent me a project in the field of bitcoins and blockchain with a question: Look? What do you think?

99% of them are not the Blockchain investments at all. Basically, there are different companies registered in different jurisdictions and they provide variety of services. Here an example of such company. If the property is not registered on the blockchain and has its ends on paper in some jurisdictions, it is not a blockchain investment at all. Such an organization will never be more marginal than organization consisting of a code and not paying a bribe to all sorts of crooks. Of course, there are many situations where this approach is needed. Especially in the services at the junction with the Fiat economy, because the Government learned very well how to keep the ball of money holders.

This article is NOT about investing in such kind of companies. It is highly recommended NOT to invest your hard-earned bitcoins in such enterprises because risks are much higher.

Anyway, a journey to the blockchain investments begins from buying Bitcoins, as all existing cryptocurrencies and assets are traded primarily to Bitcoin. Of course, you can start from mining. But this article is not for those guys who are willing to wrestle over how to buy hardware to solve problems with electricity, cooling, to suffer with the software, and then monitor it around the clock. Such guys are not needed in this article. They’ll figure it out. This article is for the lazy you. You want to make a decision, press the button (alone and green), and immediately get incredible profit.

If you are lucky and your country do not prohibit the purchase of bitcoins (e.g like in Russia) you can buy Bitcoins by credit card or Paypal.

But at first — know how to store your money! Start from this article.

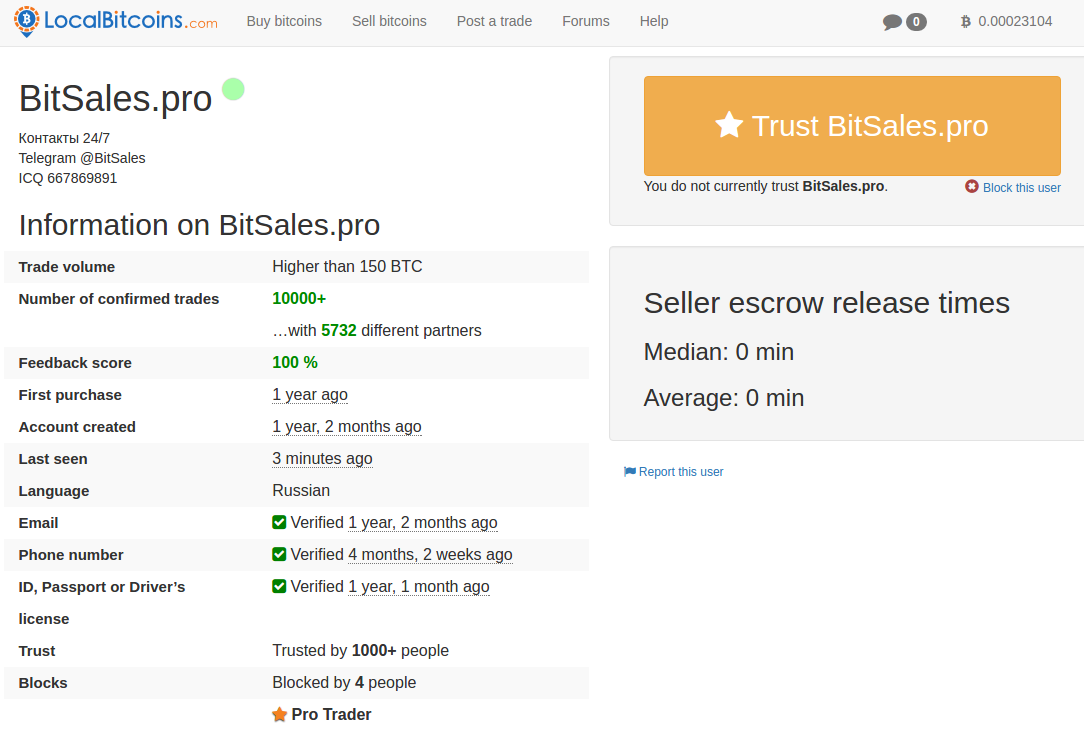

So, go to Localbitcoins. This is such a great global Bazaar where everyone can handle Bitcoins for the national currency. Vendors have build great reputation. So of course you can be cheated, but traders do value their reputation and the whole thing works quite well.

Sign up. Go to the Security tab and go through the quest to get the “Strong” title.

You can skip this step, of course, but I have warned you. Yeah. By the way, remember that the password must be unique and long. Next, select the seller. Not all sellers are good for you . The amount may be not suitable for you or a transaction method. Sometimes seller can be muddy. Your task is to find a guy who has a large number of transactions, faster transaction processing, good rating, etc. Have a good time.

Once the ad has attracted, go into it and look for seller’s terms which are written on the right. Read them carefully! If you agree, enter the quantity you wish to purchase and write a short message. For example :

I’m here for the first time. I can be blunt. But I’ll try not to be blunt. And Yes! I will use bank transfer from “name of the bank”.

And here the solemn moment! Big green button! Press. After a while you will get the answer. Send money according to specified details.

After payment go to the ad and click on the “I paid” button. The seller may wait for while, and after some time, from 1 minute to hours, you will see updated balance in your account, and the transaction is deemed closed. If you like it, feel free to give good feedback to the seller. They love it and you can get feedback in return. You will be back, right?

Congratulations! But it is early to rejoice. While bitcoins are stored in Localbitcoins it’s not your bitcoins, but their. So we go to the next step.

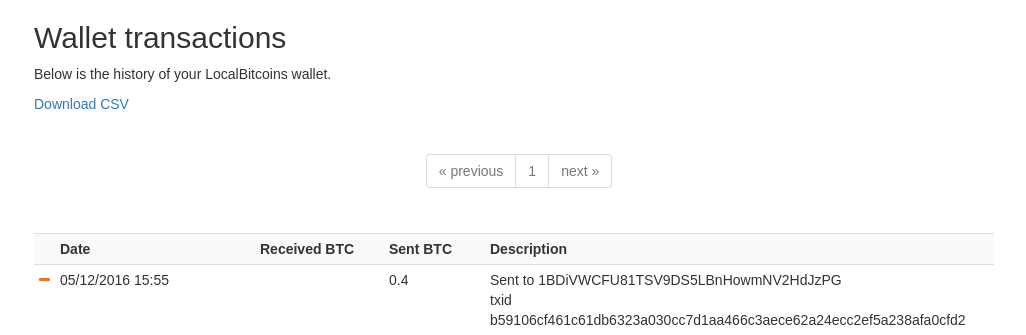

Thus, we assume that you successfully create secured wallet and your private key is only you and no one else.

Well, you copied the address from your local wallet and now we return to the section Wallet on Localbitcoins. Paste the address from clipboard in the address box, then enter the amount of bitcoins — every last Satoshi. And click “Send from wallet”.

You can see the address where money were sent, and the most valuable information is txid or transaction id. By this ID you can very easily check Localbitcoins, if he is lying to you or not. Copypaste this ID. Next, go to the website of any block explorer and enter this ID in the search. For example, here or here. By the way, it is the first historic transaction that Satoshi started.

I should mention a little about block explorer. One of the sweetest pieces of blockchain technology is the ability to overlook this database (it’s called the blockchain or chain of blocks) in real time to any person and robot on the Earth! It has nothing to do with auditor. Every last bit can be seen and proven. The government and banks do not want to give you such openness, because all the crooks will immediately light up.

So, you look in your wallet and get proud of your bitcoins. But, intuition tells you that it can’t be actually so great. There is must be a catch. The source code of the bitcoin nodes (they confirm a transaction) is open-source, the entire historical database is available and verifiable, the source code for the wallet is opened. There must be a catch. The catch is that your bitcoins exist only as digital recording and this fact is accepted by all other users of Bitcoin network. For proving the right of ownership you can only provide a digital signature calculated using your unique private key. It turns out that this is the nature of digital ownership of new generation. We have to live in this digital illusion, in which the key religion and science is math, not even physics. That’s the trick.

Enough sentimentality. Now you have your bitcoins, but the path only begins, because the blockchain technology, which made the Bitcoin has spawned with a lot of interesting things.

This section generally worthy to write a separate book . I will not stoop to the recommendations exactly where to invest, but just go through some areas to plant ideas.

Decentralized infrastructure

Any computer in any network does three things: (1a) receives some data, then (2) makes some transformation, i.e. calculates, then decides that (3) save for longer, and that (1b) forwards in response to the request. Our brain works identical. From this you can make the assumption that all decentralized infrastucture will move in three directions:

And here the fun begins:

After reading this point, dear reader, you hopefully realised that investing in cryptocurrencies is interesting, cool and really promising, but it seems difficult. So you need to decide (1) to invest your bitcoins independently or (2) to entrust this task to someone. Each approach has its pros and cons. Let’s see them in order.

Pros:

Cons:

Where to invest?

So, you weighed all the “pros” and “cons” and decided to do it yourself. This is commendable decision. My initial idea was that all people can and want do it themselves. Today, unfortunately, this is not quite true. At this stage, such projects like cyber•Fund may help you.

Roughly speaking, it is possible examine the state of the economy in one place. Cyber.fund adjust the price and number of tokens in all significant blockchain systems. But the most important is cyber•Rating. The complete methodology is disclosed in this paper.

Once you realised where to invest, you need to send bitcoins to the exchange, where the target asset is being traded . In our case it will be Poloniex. The truth is that Poloniex may disappear tomorrow and we will got a new meme in the Internet.

Therefore, you make these operations at your own risk. I estimate the probability of closing for each particular exchange during the year is 10%. In this series, and Coinbase and Poloniex and all sorts of banks like Xapo.

But now we use Poloniex because there are a lot of currencies and good liquidity. Decentralized trade is one of the most promising areas, but it is still at the very beginning. I think with the development of projects such as BitShares and BitSquare for one year or two years it will be a worthy alternative to Localbitcoins and Poloniex with good liquidity.

If Poloniex for some reason do not satisfy you, there are still a lot of other exchanges. Have fun choosing them. The process is the same everywhere:

Keep in mind that all serious. Exchanges are real.

Here comes the fun part. This step depends entirely on what you decided invest. Without this step, you will not be able to guarantee the long-term safety of your investments. I can say that on every official website of every blockchain system there are links to different wallets. Which trust or not to trust — it is your decision. I will list the tools that I use myself:

This is not an exhaustive list, but may cover 80% of the needs for a beginner. Each of these software requires that you saved the private key. Do it.

I have described in details the best way for storing Bitcoins and Ether in this article

After all of these procedures, you need to withdraw assets from Poloniex to your wallets. Save the private key as closely and carefully as you can. After these steps, the property becomes yours. Next you are faced with the task of monitoring the value of your portfolio.

You can use such Google Spreadsheets with API integration or use such systems like cyber.fund

That’s all. Still have questions? I will answer them with pleasure!

Please, write your comments and questions below. And one more thing: let’s spread the knowledge. Recommend and Share this article. Thank you for reading!

Here’s a cool song for dessert.