Do you know what is Cryptocurrency? If no then you must be very well aware of the same as it is a modern way of doing transactions between two or more than two parties. Do you really want to know about starting with the cryptocurrency? Yes? If so, then yes, here is the complete beginner’s guide to let you know everything about such cryptocurrency. Let’s start with some of the basic details or information-

What is Cryptocurrency?

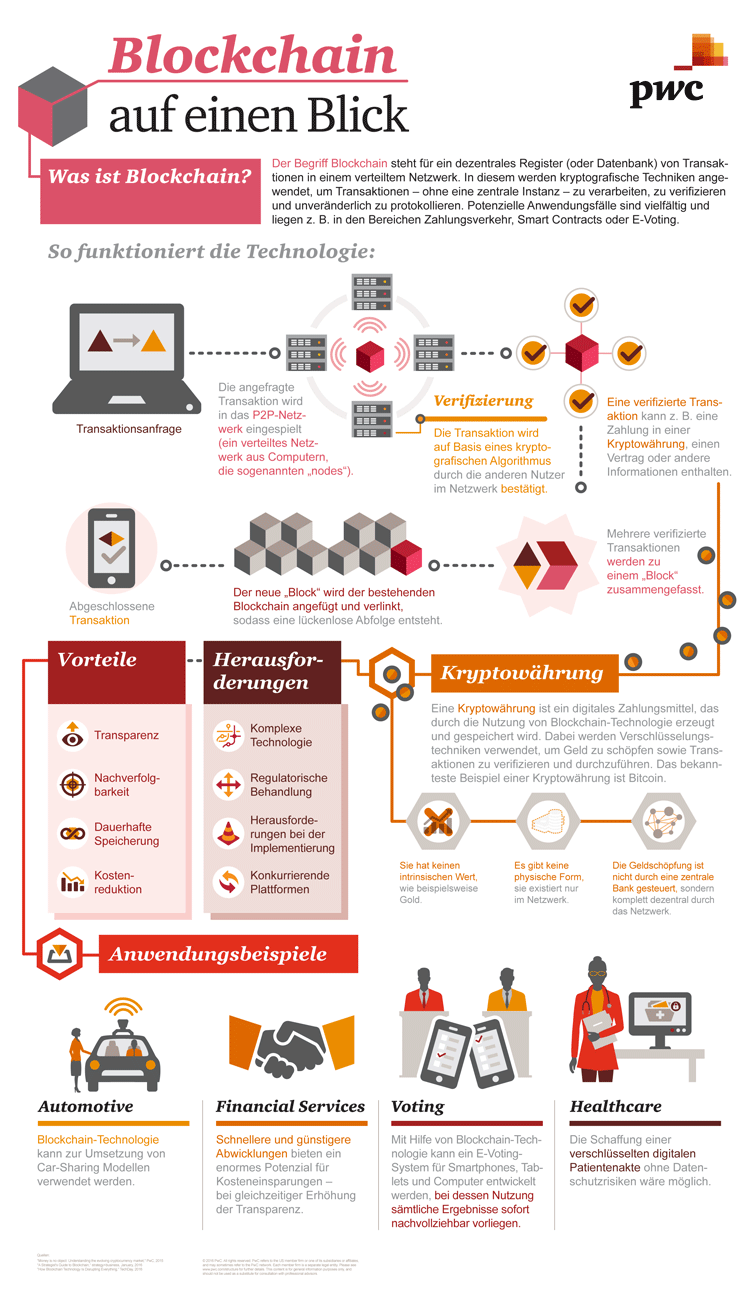

As this is a modern and digital era, everyone is using the digital forms in every field whether it is about making some urgent payments or anything else but still, a huge part of the population is not aware of the cryptocurrency. It is a kind or form of digital money which is designed to make the transactions to be more secure and easier. It is a kind of virtual currency which uses the concept of cryptography so as to safely verify the transactions and to control the creation of the possible scams. There are some specific terms and conditions in such concept and no one can change the entries in the database unless and until such terms and conditions may get fulfilled. Such a currency has been associated with the internet.

The Cryptocurrency basically uses the concept of cryptography which is reckoned as a process of converting the kind of legible information into an uncrackable code. This uncrackable code is generally converted in order to track the purchases and different online transfers. Such a concept was introduced in order to make the communication system to be secure and to make the transfer of information easier than ever.

About the forms of Cryptocurrency?

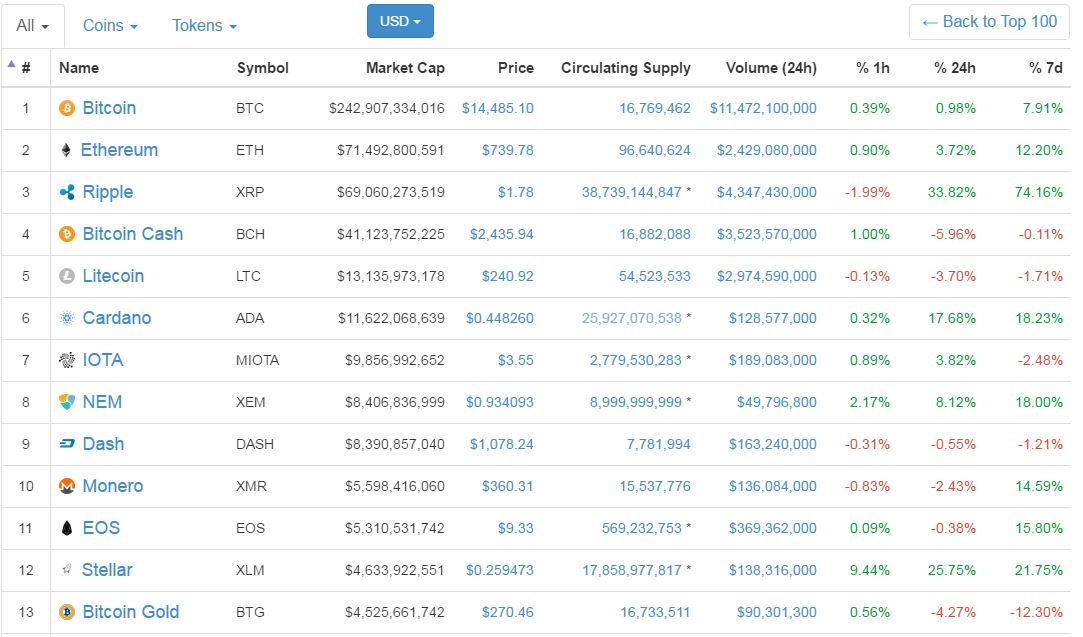

The very first form of cryptocurrency was the bitcoin which was created earlier in 2009. It is reckoned as one of the best-known forms of currencies. During some of the recent days, the Bitcoin Currency has scored much more importance after losing about 30% of its value in the past days. The cryptocurrency is a kind of digital currency which is broadly used for the encryption techniques unlike the other fiat currencies such as US dollars, euros, and yen. The cryptocurrency is not usually regulated or controlled by any of the banks, governments, or other centralized financial authorities as well.

About the Bitcoin Currency

Don’t you know much more about such currency? It is a kind of cryptocurrency which as almost changed the way of doing the online transactions. Bitcoin is reckoned as one of the fastest and safest or freest ways of transferring the money and information from one place to any other place in the entire world. Generally, the Central Banks of the countries work to regularize the entire inflow or outflow of money within the country but there is no central control in this bitcoin cryptocurrency. Bitcoin is a perfect form of cryptocurrency which provides the unique chances to the businesses to easily transact with everyone and anywhere in the entire globe. Bitcoin has thus, reduced the need to follow a number of banking rules.

Bitcoin is a cryptocurrency form which does not usually discriminate against any single one background. This form and type of cryptocurrency always focus on making it very much sure that you will be able to do the secure transactions without facing any more risks or hassles. You just need an internet connection to identify yourself to this Bitcoin Cryptocurrency Protocol. You need not face any possible heartbreaks or inflation issues in such bitcoin cryptocurrency. About 21 million bitcoins are there in the entire marketplace. It is one of the truly global currencies which does not consider the facts such as your place to live or your work to do.

How are cryptocurrency records kept?

The cryptocurrency is a kind of digital public ledger system where you can record all the transactions which collectively known as the blockchain. Every single record or the series of records on the entire blockchain is known as a block. This block will then send to the network and then automatically added to the blockchain for a valid transfer. These blocks can’t then changed once get verified.

How can I buy and use cryptocurrency?

Cryptocurrency is a kind of volatile market which contains the fluctuating exchange rates. Bitcoin is the most valuable kind of cryptocurrency. You can get a digital key to address the currency on purchasing such Cryptocurrency. You can then access this key to validate or approve the transactions. It is a perfect place to keep your key to be safe and secure.

What can you do with cryptocurrency?

You can use the cryptocurrency in different forms such as buying goods or to invest the money. Let’s discuss some of the different uses of cryptocurrency-

- Buying Goods and Services- Now, it is a modern era in which you can buy the goods by using the cryptocurrency. You can now pay for anything via online by using this cryptocurrency. You may find some difficulties while finding out the merchants who may accept the cryptocurrency. But surely, it is not a difficult task, you can easily find the merchants online and offline. Such merchants include the retailers and the local shop owners. Not only this but you can also pay for the flights, hotels, and many other things via such cryptocurrency. Numerous other digital currencies including the Ripple, Litecoin, and Ethereum are still not accepted.

- Investing Money- Cryptocurrencies can provide you the high-risk investments. Numerous people are there who still don’t believe that Cryptocurrencies are the best and one of the hottest investment opportunities. Numerous other people are also there who have now become much more successful by investing in the bitcoins. It is one of the most recognizable kinds of digital currencies which was valued at $800 and this value exceeded to $7,000 in November 2017. Apart from this, you can also choose the Ethereum as the second most valued cryptocurrency whose value is continuously getting increased.

Is it really easy to buy the bitcoins?

Numerous different exchange systems are now easily available through which you can now buy the cryptocurrencies online. There is a huge share of cryptocurrency in the entire marketplace and the share has now fallen from about 90 to 40%. Numerous different currencies are now available in the market and most of them include the coin based currency system which is entirely known as the Bitcoin.

You just need a simple and easy way to store the cryptocurrency on buying it for only once. You need not store your exchanges or money amounts offline anymore as such time has now been passed away and the digital era is nowhere which has made it much easier to invest your valuable money in the online wallet exchange systems.

How to get started?

If you really want to start with the cryptocurrency then you need to understand such important terms-

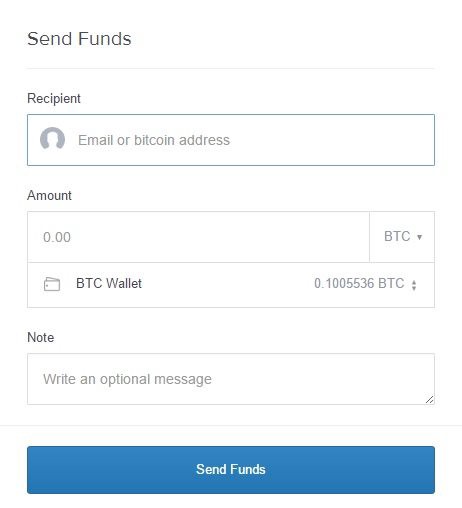

- Wallets- Such online wallets are just like the bank accounts and you can store your money in the same to be used during the online transactions.

- Exchanges- Here, you will get the entire information related to the transfer of money online through different exchange systems.

- Trading- You will get the information related to the ways or best methods to start trading by using the cryptocurrency in the markets.

Some other ways to start with the cryptocurrency is the management of your portfolio, some security and safety concerns, some common mistakes to avoid the losses, general tips and advice, and much more.

What are the wallets?

You can consider such online wallets as the crypto bank accounts where you can store your money online or in the form of tokens.

Generally, numerous ways are there to get a wallet but one of the easiest and safest ways to get such an online wallet is to sign up for an exchange system by which you can easily buy or sell your cryptocurrencies in the form of tokens.

The system of exchanging the tokens through wallets-

Usually, every single wallet has its own unique address but you will get a totally different wallet address on starting your trade on about 3 different exchanges.

What are the different types of wallets?

As this is a modern era, people are now preferring the online wallets to secure their money as such wallets are reckoned as the best & safest ways. Have a slight look at the different kinds of wallets-

- Desktop wallets- Different software like the Cryptonator will then allow you to send and store the cryptocurrency to track the transactions. Such online wallets are generally created by the token developers.

- Online wallets- Such cryptocurrency keys can be stored online through the exchanging platforms such as coinbase or circle. Such online wallets have now reduced the risk of hacks or other possible scams. You need not face anymore collapse of exchanges.

- Mobile wallets- With the help of different apps such as the blockchain store and others, you can now easily make your payments online just by using your own mobile device. These are the app-based wallets and thus, you need to install it on your mobile device.

- Paper wallets- Some of the reputed websites are also offering you the paper wallets by generating the pieces of paper with QR codes. Such QR codes generally contain the private keys such as letters and numbers with some special characters as well.

- Hardware wallets- To utilize the hardware wallets, you can simply use a USB device so as to store the bitcoin in an electronic form. Hardware wallets are generally reckoned as the best ways to secure your token amounts.

What are the popular exchanges?

- Coinbase- It is reckoned as one of the best, safest, newest, and largest Bitcoin exchanges based in the US. It is a kind of popular exchange which ultimately allows you to buy foud different cryptocurrencies such as Litecoin, Ethereum, Bitcoin, and Bitcoin Cash. You need not face any hassles as you can now simply buy such cryptocurrencies via your credit card with a weekly limit of about $250. If you want, then such limit can also get increased by paying 4% as the processing fee.

- Bittrex- It is another popular exchange which provides you different opportunities to start the trade. There is no option to deposit any Fiat currency directly into the Bittrex exchange. Firstly, you need to buy the other kinds of cryptocurrencies such as bitcoin or Ethereum and then transfer them into this Bittrex so as to start trading.

- Binance- Such an exchange was recently launched in 2017 and based in Hong Kong. The entire western part of the world is now getting numerous benefits of such platform.

- Bitfinex- It is another large exchange system which is based in Hong Kong. It offers you the greatest Bitcoin value which usually targets the traders based in North America. It also offers you a wider range of altcoins.

- Poloniex- This exchange is based in the United States and generally allows trading with a few dozen cryptocurrencies.

Some types of trades based on Binance-

- Limit Trade-It is a kind of trade system which allows you to buy or sell your tokens at a fixed price by specifying your requirement of tokens at a particular point in time.

- Market Trade- You need to buy some of the tokens on market rates if they may be based on the Binance. It is the best and quickest way to buy or sell the tokens on an urgent basis.

- Stop Limit- It generally allows you to set a limit on which you can easily buy or sell your tokens at a particular period of time.

Some more things to affect or enhance the Cryptocurrency-

- Managing your portfolio- It is an important step to consider if you really want to spread out different exchanges and dozens of wallets. You need to get the multitude of addresses and locations as your major chore. If you need to manage your portfolio then you can try by setting up an excel spreadsheet by syncing with all your important data. It is the best way to represent your actual gains and losses.

- Blackfolio- It is one of the most popular apps which was earlier released with a single motive of managing your crypto investments. You must also set the price alerts to fetch all the related important information.

Related pros-

- This Blockfolio can track over about 2000 altcoins

- It can also make you able to set the price alerts

- It also supports different fiat currencies

- It is easily available iOS and Android

Related Cons-

- It allows you to do the manual transactions only

- The related graphs are not interactive

- Delta- It is one of the safest and newest apps which allows you to manage all your crypto investments so as to represent your net gains and losses. You must carefully enter your manual transactions in order to calculate your profits. Delta UX is a perfectly designed and user-friendly interface.

Related Pros-

- It can also track over about 2000 altcoins

- Price alerts are also there

- Fiat currencies are also supported

- It is a much better option than the Blockfolio

- It is also available for both iOS and Android

Related Cons-

- You may find it difficult to track down your trade transactions accurately

- It may not allow the interactive graphs

- There is no section for the news

- It consists of the Matrix Portfolio

- Other Security & Safety Concerns- You must also need to take care of the safety and security concerns while trading with the cryptocurrencies. Surely, you won’t have to face any possible additional inconveniences on taking a very well care of the safety and security concerns.

Some important things to consider-

- You must enable the two-factor authentication (2FA)

- Always focus on using the long passwords which may be secure

- Don’t log in again and again

Some common mistakes to avoid-

- You must take care of sending the tokens to any of the wrong wallet addresses

- Always take care of some general tips and advice

- Invest only in the best

- Don’t time the market

- Buying the dips

- You must also diversify your portfolio

- Make a strong research by analyzing your team, technology, token forms, timelines

Conclusion-

If you are really thinking about using the cryptocurrency or may start trading such currencies then you need to analyze all the things mentioned above. If you are very much concerned about such issues then you can now get the life-changing returns on investing your valuable money in the cryptocurrencies.

Original article and pictures take www.cryptobitcoinsguide.com site

.gif)